If you’re a seller seeking intended for an management, here’s what you should know about the M&A method. First of all, have a tendency assume you will absolutely the only get together interested in this company. It’s often better to explore multiple offers than to take the first one. Second, set a perfect closing time frame. While discounts will always take longer than predicted, you can speed up the process simply by tracking against a general schedule.

Third, be sure you do your homework. Have to see the financials of the enterprise you’re looking at and how it’s going to affect the company. For example , you might want to take a look at an earnout, which is a repayment made to shareholders of the provider that you’re retailing. Earnouts will be paid after the acquisition is done and the company reaches specified performance marks. Unfortunately, these payouts are certainly more of a daydream than a reality, plus they rarely pay out the sellers what they hope to get.

In addition to evaluating the target company, recognize an attack do a SWOT analysis. This kind of analysis assists you to determine the simplest way to approach an offer. It can also function as a tool to negotiate complicated requests together with the target company. It’s important to include https://acquisition-sciences.com/2021/12/22/benefits-of-using-a-business-software-service/ all the shareholders in the process, such as minority kinds. If you want to hit your objectives, make sure they understand what they’re getting. Keep in mind, your M&A deal should be beneficial for everybody, not just you.

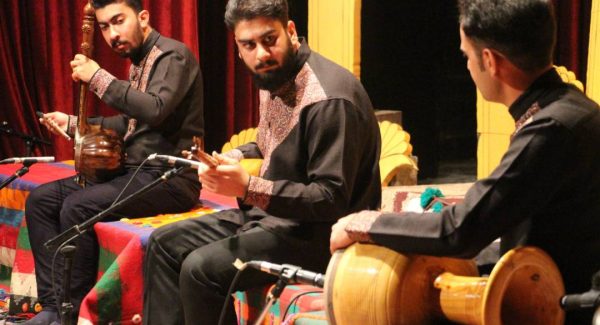

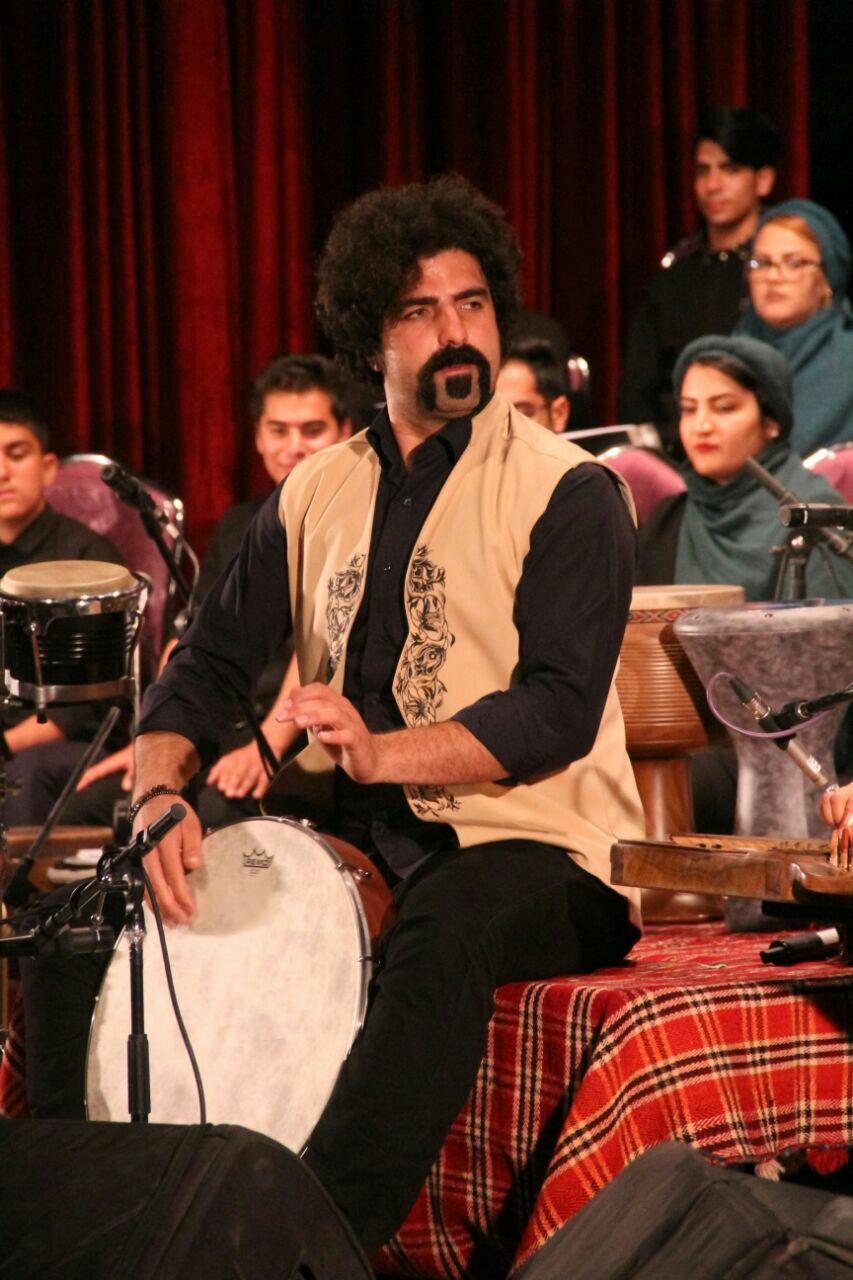

برگزاری شب شعر بانوی آب در مرودشت

برگزاری شب شعر بانوی آب در مرودشت ثبت بیش از ۱۲ هزار ماموریت توسط اورژانس مرودشت

ثبت بیش از ۱۲ هزار ماموریت توسط اورژانس مرودشت از کتاب “شهر استخر” رونمایی شد

از کتاب “شهر استخر” رونمایی شد تجلیل از بانوان رابطین ادارات مرودشت با حضور مدیرکل امور بانوان فارس

تجلیل از بانوان رابطین ادارات مرودشت با حضور مدیرکل امور بانوان فارس تجلیل از مادران و همسران موفق در همایش “مادران بهشتی”

تجلیل از مادران و همسران موفق در همایش “مادران بهشتی” برگزاری کارگروه ترویج فرهنگ ایثار و شهادت شهرستان مرودشت

برگزاری کارگروه ترویج فرهنگ ایثار و شهادت شهرستان مرودشت برگزاری آزمون سراسری حفظ و مفاهیم قرآن کریم در مرودشت

برگزاری آزمون سراسری حفظ و مفاهیم قرآن کریم در مرودشت برگزاری مراسم اختتامیه جشنواره “ترسیم همدلی”

برگزاری مراسم اختتامیه جشنواره “ترسیم همدلی” برگزاری پنجمین جلسه شورای فرهنگ عمومی شهرستان مرودشت

برگزاری پنجمین جلسه شورای فرهنگ عمومی شهرستان مرودشت افتتاح نخستین بازارچه دائمی صنایع دستی در مرودشت

افتتاح نخستین بازارچه دائمی صنایع دستی در مرودشت افتتاح سایت تخصصی آموزش صنعت برق در مرکز آموزش فنی و حرفه ای شهرستان مرودشت

افتتاح سایت تخصصی آموزش صنعت برق در مرکز آموزش فنی و حرفه ای شهرستان مرودشت دیدار اهالی فرهنگ و هنر سیدان با مبارزین دوران انقلاب اسلامی

دیدار اهالی فرهنگ و هنر سیدان با مبارزین دوران انقلاب اسلامی برگزاری مانور اسکان اضطراری در مرودشت

برگزاری مانور اسکان اضطراری در مرودشت دیدار معاون پارلمانی وزیر فرهنگ و ارشاد اسلامی با هنرمندان شهرستان مرودشت

دیدار معاون پارلمانی وزیر فرهنگ و ارشاد اسلامی با هنرمندان شهرستان مرودشت افتتاح خانه فرهنگ رامجرد

افتتاح خانه فرهنگ رامجرد