A shareholder proposal is mostly a mechanism meant for shareholders to inquire the aboard of company directors of a enterprise to take a certain actions. It is commonly included in the proxy server statement and voted upon at an annual reaching or a distinctive meeting of shareholders.

Shareholder proposals undoubtedly are a popular and effective ways of engaging with managing on issues that matter to them. Additionally they help sanction the voting interests of investors and generate a more wide open and translucent process with respect to governing companies.

Whether or not a shareholder proposal is successful depends on several factors, such as quality and the scope within the ask, the proponent’s history in filing similar proposals and the company’s capability to defend against this. Regardless of the result, you should develop an bridal plan for the proposal to make certain the issue is over heard and addressed.

Proposals linked to environmental and social topics, notably accounting compensation, will continue to be the most popular types of aktionär proposals. These plans address a wide range of concerns, via disclosure of climate-related hazards and individual capital administration to oversight and planning such matters.

The COVID-19 pandemic prompted a renewed concentrate on pay disparities within companies’ workforces, and fresh proposals related to this matter are likely to come through in the 2021 proxy season. Likewise, plans related to governance issues will probably be popular, particularly those related to impartial board chair, director overboarding and a reduction in the ownership threshold with respect to access to specialized meetings.

Generally, a board must consider all aktionär proposals cautiously and resist changes that this believes will not likely be constructive or perhaps result in great governance. With the https://shareholderproposals.com/online-deals-in-a-data-room-common-responses-and-the-requirement-to-manage-them same time, it ought to be willing to produce modifications that happen to be in the best interests of the business stakeholders and definitely will promote openness, good governance and decisions in the best interest of its shareholders.

For example , when a board can determine that it does not have the resources to pursue a proposal within a reasonable method and will not be able to obtain support from investors to advance a change, it may choose to withdraw the proposal. Additionally, it may be willing to negotiate together with the proponent over the withdrawal of your proposal as a swap for additional disclosure.

There are a number of practical is important that table members should know, including the need to forward newly arriving shareholder proposals to the suitable personnel, hold on to envelopes and shipping product labels, and ensure on time review of any kind of deficiencies in the shareholder proposal process. In addition, boards should remember that they can be responsible for sending opposition statements to proponents not any later than 30 days before the company’s defined proxy assertion.

A aktionär who wants to upload a shareholder pitch must be a shareholder on the company and possess continuously organised at least $2, 000 in the true market value or 1 percent of the company’s securities no less than one year by the date for the proposed aktionär proposal. Additionally , a pitch must will include a notice with the proposed shareholder actions in the kind prescribed by the SEC and be filed in compliance while using applicable rules.

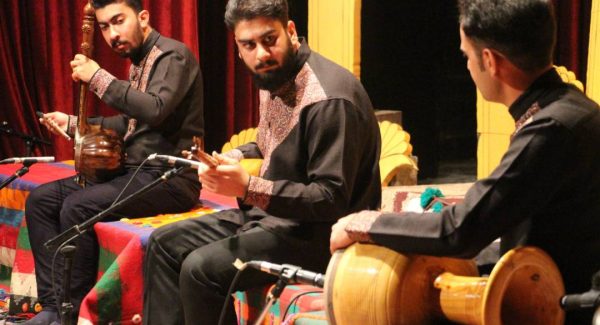

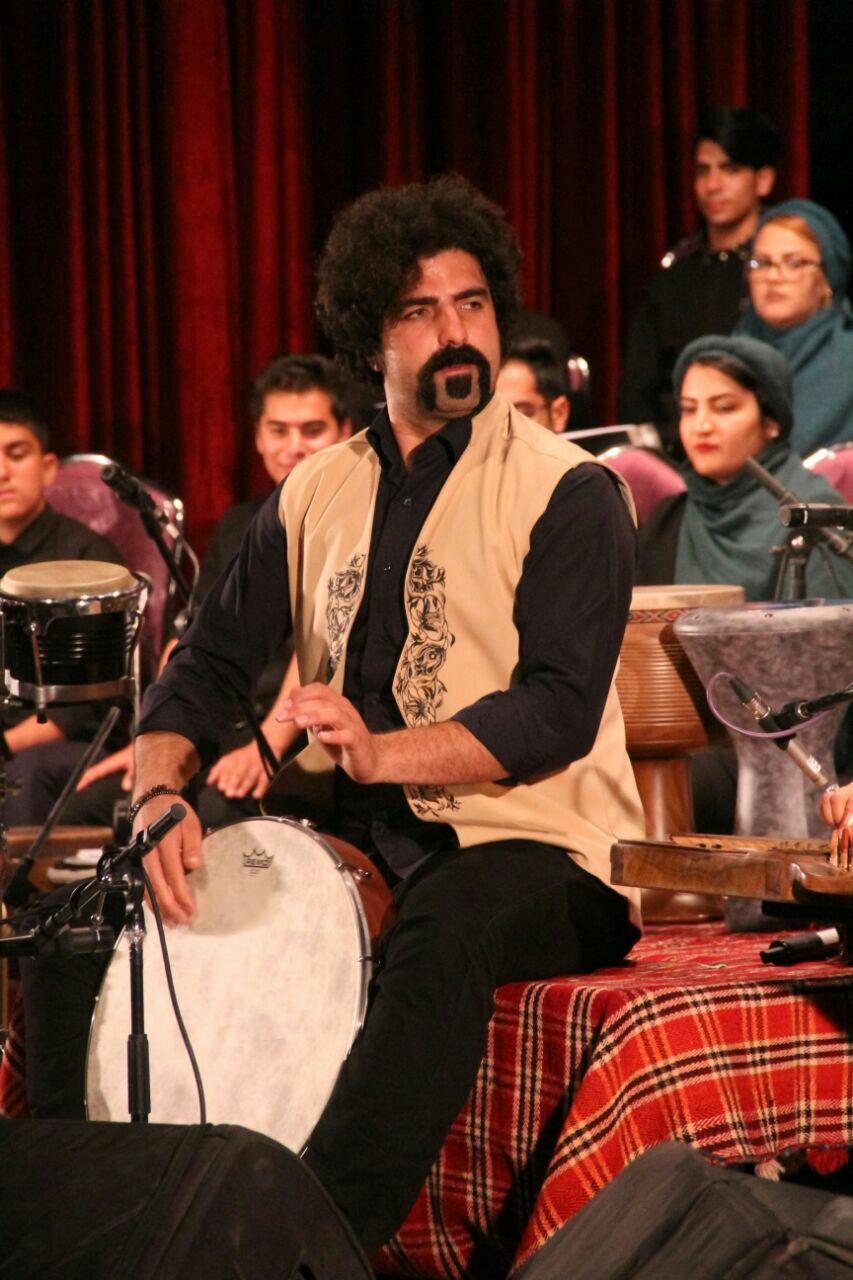

برگزاری شب شعر بانوی آب در مرودشت

برگزاری شب شعر بانوی آب در مرودشت ثبت بیش از ۱۲ هزار ماموریت توسط اورژانس مرودشت

ثبت بیش از ۱۲ هزار ماموریت توسط اورژانس مرودشت از کتاب “شهر استخر” رونمایی شد

از کتاب “شهر استخر” رونمایی شد تجلیل از بانوان رابطین ادارات مرودشت با حضور مدیرکل امور بانوان فارس

تجلیل از بانوان رابطین ادارات مرودشت با حضور مدیرکل امور بانوان فارس تجلیل از مادران و همسران موفق در همایش “مادران بهشتی”

تجلیل از مادران و همسران موفق در همایش “مادران بهشتی” برگزاری کارگروه ترویج فرهنگ ایثار و شهادت شهرستان مرودشت

برگزاری کارگروه ترویج فرهنگ ایثار و شهادت شهرستان مرودشت برگزاری آزمون سراسری حفظ و مفاهیم قرآن کریم در مرودشت

برگزاری آزمون سراسری حفظ و مفاهیم قرآن کریم در مرودشت برگزاری مراسم اختتامیه جشنواره “ترسیم همدلی”

برگزاری مراسم اختتامیه جشنواره “ترسیم همدلی” برگزاری پنجمین جلسه شورای فرهنگ عمومی شهرستان مرودشت

برگزاری پنجمین جلسه شورای فرهنگ عمومی شهرستان مرودشت افتتاح نخستین بازارچه دائمی صنایع دستی در مرودشت

افتتاح نخستین بازارچه دائمی صنایع دستی در مرودشت افتتاح سایت تخصصی آموزش صنعت برق در مرکز آموزش فنی و حرفه ای شهرستان مرودشت

افتتاح سایت تخصصی آموزش صنعت برق در مرکز آموزش فنی و حرفه ای شهرستان مرودشت دیدار اهالی فرهنگ و هنر سیدان با مبارزین دوران انقلاب اسلامی

دیدار اهالی فرهنگ و هنر سیدان با مبارزین دوران انقلاب اسلامی برگزاری مانور اسکان اضطراری در مرودشت

برگزاری مانور اسکان اضطراری در مرودشت دیدار معاون پارلمانی وزیر فرهنگ و ارشاد اسلامی با هنرمندان شهرستان مرودشت

دیدار معاون پارلمانی وزیر فرهنگ و ارشاد اسلامی با هنرمندان شهرستان مرودشت افتتاح خانه فرهنگ رامجرد

افتتاح خانه فرهنگ رامجرد